marin county property tax calculator

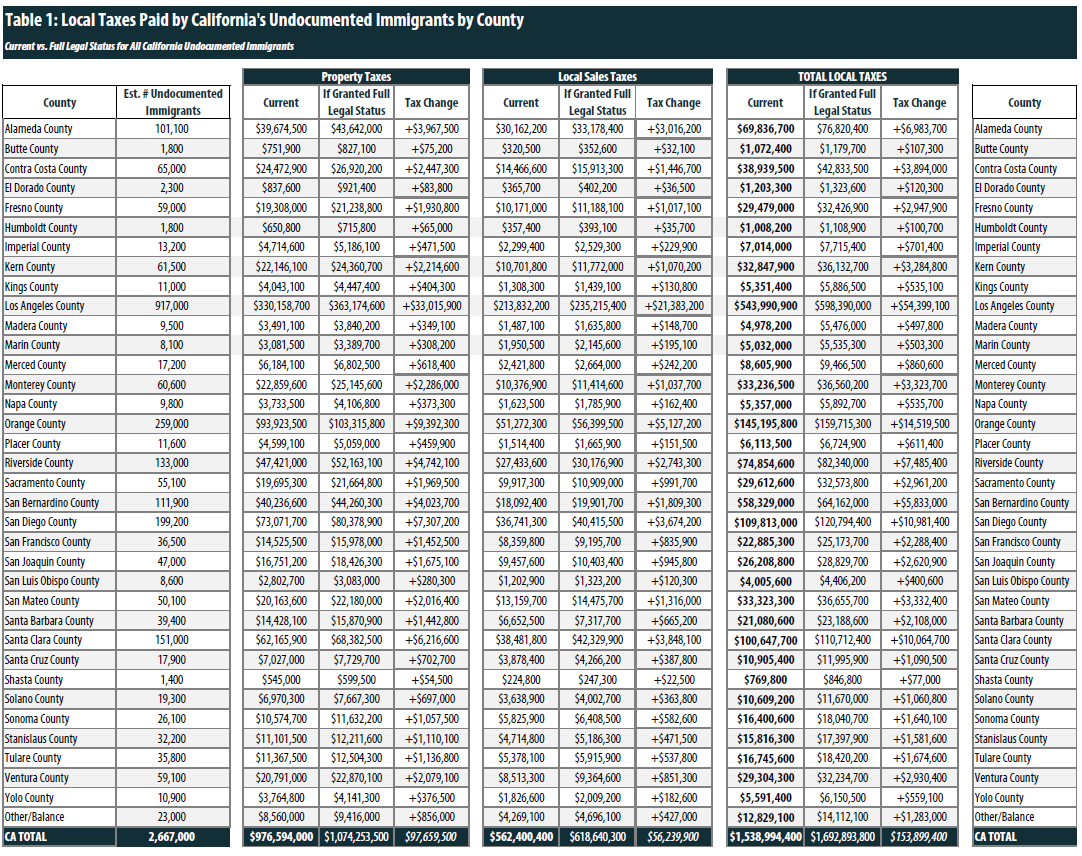

Marin County collects on average 063 of a propertys assessed. Tax Rate Book 2021-2022.

2022 Best Places To Live In Marin County Ca Niche

Tax Rate Book 2018-2019.

. Real Property Searches. The Marin County Tax Collector offers electronic payment of property taxes by phone. Use this Marin County California Mortgage Calculator to estimate your monthly mortgage payment including taxes and insurance.

Census Bureau American Community Survey 2006. Our Marion County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Tax Rate Book 2017-2018. Tax Rate Book 2020-2021.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact. For comparison the median home value in Martin County is. California Property Tax Calculator.

3473 SE Willoughby Blvd Suite 101 Stuart FL 34994 772 288-5608. Property Tax Bill Information and Due Dates. The Marin County California sales tax is 825 consisting of 600 California state sales tax and 225 Marin County local sales taxesThe local sales tax consists of a 025 county sales tax.

Overall there are three stages to real estate taxation. Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. The median property tax also known as real estate tax in Marin County is 550000 per year based on a median home value of 86800000 and a median effective property tax rate of.

For comparison the median home value in Marin County is 86800000. Taxing units include city county governments and various. The Marin County Assessor Supplemental Tax Estimator provides an estimate of the amount of supplemental taxes a taxpayer may anticipate.

Tax Rate Book 2019-2020. For comparison the median home value in Marion County is. Secured property taxes are payable in two 2 installments which are due November 1.

Property Tax Payments Mina Martinovich Department of Finance Telephone Payments. Marin county collects very high property taxes and is among the top 25 of counties in the united. The countys average effective property tax rate is 081.

Mina Martinovich Department of Finance. The supplemental tax bill is in addition to the. Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address.

Enter your Home Price and Down Payment in the. The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000. Establishing tax levies estimating property worth and then receiving the tax.

Start filing your tax return now. Secured property tax bills are mailed only once in October. If you are a person with a disability and require an accommodation to participate in a.

Martin County Property Appraiser.

California Property Tax Calculator Smartasset

San Francisco Bay Area Transfer Tax By City And County Updated For 2020 Torii Homes

Property Taxes By County Where Do People Pay The Most And Least

Property Tax By County Property Tax Calculator Rethority

Property Tax By County Property Tax Calculator Rethority

Where Do Homeowners Pay The Most In Property Taxes The Washington Post

Riverside County Ca Property Tax Search And Records Propertyshark

California Sales Tax Rate Rates Calculator Avalara

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

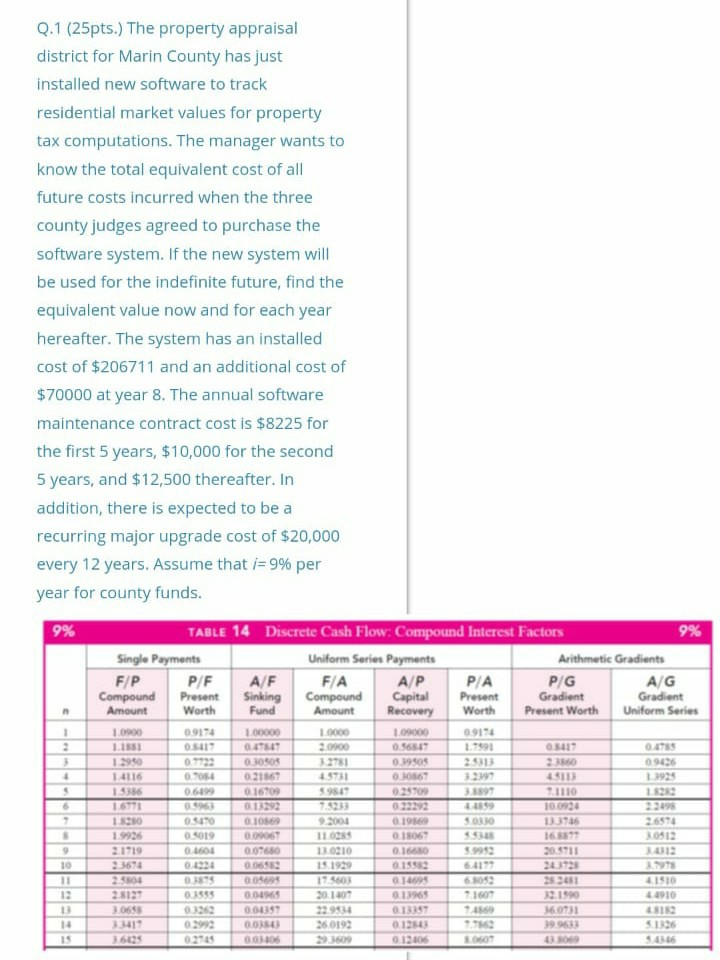

Solved The Property Appraisal District For Marin County Has Chegg Com

Marin County California Wikipedia

Why Is Marin County So White Kqed

Property Tax Property Taxes Were Up 5 4 On Average In 2020 Fortune

New California Law Adds To Prop 19 Rush For North Bay Property Tax Transfers

San Francisco Property Tax Rate Set To Drop 0 23 Percent

Marin Library System Seeks Parcel Tax Hike Amid Rising Costs

Despite What You Ve Read This Is Not The Bay Area S Richest City The Front Steps San Francisco Real Estate